TruckElectric

Well-known member

- First Name

- Bryan

- Joined

- Jun 16, 2020

- Threads

- 609

- Messages

- 2,004

- Reaction score

- 1,493

- Location

- Texas

- Vehicles

- Dodge Ram diesel

- Occupation

- Retired

- Thread starter

- #1

Tesla: A Justification For A $3T Company

Oct. 25, 2021 8:00 PM ET Tesla, Inc. (TSLA)LI, NIO, XPEV28

Summary

Xiaolu Chu/Getty Images News

What prompted this article?

Since I wrote my article about Tesla’s (NASDAQ:TSLA) April 2019 (Tesla: Why Did The Autonomy Vehicle Day Turn Me Bullish?), I have been following the company very diligently, studying every piece of news about it, and putting my money where my mouth is: On a weekly basis, I have been writing two put contracts priced at about 10-20% lower than the current price and expiring four weeks later; occasionally, I had to roll over these options for another four weeks at a lower strike price. This investment strategy has been generating for me a good consistent weekly income.

My bullish position on Tesla has been growing consistently the more I studied the company and its operations. I remember reading very negative articles related to Tesla’s competitive landscape and the financial position of the company. The commonality that I recognized in these articles is that the authors missed understanding the “new business model” that Tesla is introducing. I thus decided to write an article that expresses my opinion about how I see Tesla different from an operational and strategic perspective and how this difference renders its current valuation of $900B as “low”.

Summary and Paper Thesis

This article looks at the current Discounted Cash Flow model for Tesla and the growth rates that are taken into consideration to render its current price. The article then looks at the key competitive advantages that Tesla has and the new business model that it introduces; this is the bulk of the article.

Based on these advantages and the new business model the article adjusts the assumptions of the current valuation to come up with a new company valuation. The article then looks at the risks that Tesla could be facing.

Tesla’s Current Valuation

The theoretical way of conducting discounted cash flow analysis would adopt the following steps:

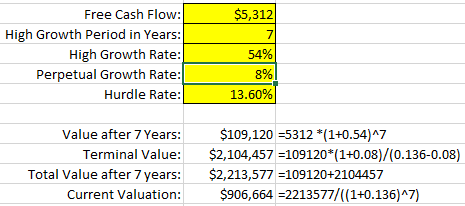

Here are the assumptions used to get the current valuation:

Source: Created by Author

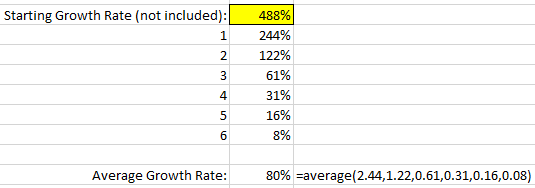

Please note that the 54% growth rate calculated here is a conservative number given that the growth rate last year was 488%.

How is Tesla different from other auto manufacturers?

This section demonstrates the differences between Tesla and the competition which is trying to catch up. We will review here different areas that are sometimes over-looked by financial analysts.

Vertical Integration Strategy

In 2016, Elon Musk said that Tesla would be increasing vertical integration in order to “have the ability to produce almost any part of the car at will and alleviate risk with suppliers ... if 2% of suppliers aren’t ready, we can’t make the car.”

According to Behzad Benam in his Medium article: “Why Vertical Integration Made Tesla More Powerful”, the advantages of vertical integration for Tesla include:

This video from Casgains Academy presents a very nice summary of how Tesla is using vertical integration to its advantage.

Source: YouTube Casgains Academy Channel: Tesla's Secret Weapon: Vertical Integration

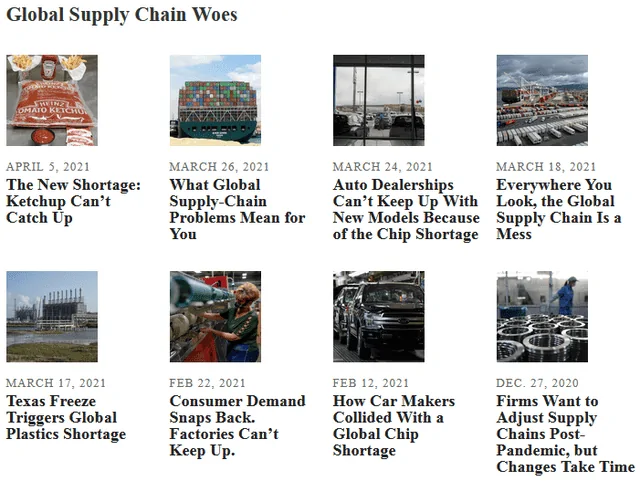

To demonstrate how this vertical integration strategy was beneficial to Tesla, let’s look at the shutdowns that happened in auto manufacturing over the last 12 months because of supply chain crisis. The shutdown for Tesla was just for a few days in February 2021, which pales compared to the extended shutdowns of other manufacturers.

Source: Some Wall Street Journal articles about the Supply Chain Crisis

Chip Technology

One of the biggest challenges in Artificial Intelligence, AI, is the speed of the processors required for both training the neural networks and to make decisions based on the trained neural networks. Neural networks for autonomous driving need to be continuously retrained with new data, and the retraining is usually done with an ever larger amount of data elements. Corners cannot be cut in this training as mistakes are unforgiven when lives of passengers are on the line. In addition, computers that drive the autonomous driving decisions (speed and steering) need to be specifically designed for speed.

Except for Tesla, companies working on AI for autonomous driving are using GPUs from Nvidia (NASDAQ:NVDA) and (NASDAQ:AMD). These are generic processors that are designed for graphics processing with hundreds of CPUs within each chip. While the GPU speed is remarkable, they are still generic chips that are not as fast as chips specifically designed for autonomous driving.

Tesla has gone a different route and created its own chips for both the neural network training and for the processing the neural networks while driving; this is one of the reasons that Tesla might have been the only company that was not negatively impacted by the world chip shortages in 2021 which resulted in shutting down many auto manufacturers for extended periods.

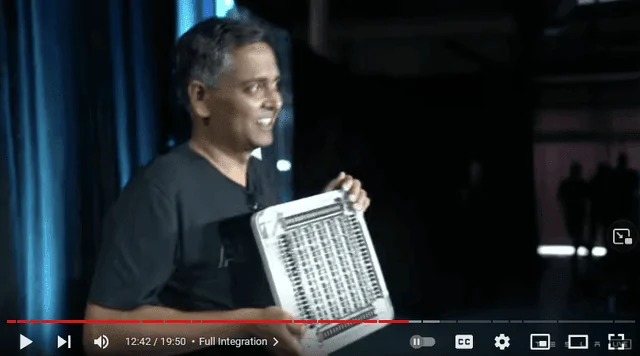

In August 2021, at Tesla AI Day, Tesla Engineer Genesh Venugopal, discussed Project Dojo and the AI chip that will power the company's full self-driving technology neural network training. You can read about the impressive Dojo technology in Tesla’s published white paper: “Tesla Dojo Technology”.

Source, YouTube CNET Highlights Channel: Tesla's AI chip REVEALED! (Project Dojo)

In addition, Tesla designed the FSD chip; Tesla’s AI website describes the functions of this chip.

This two-pronged approach is a remarkable one that puts Tesla many years ahead of its competition.

Auto Pilot, Vision, Data and AI Technology

Tesla adopted a different philosophy in its autonomous driving, and that is to use vision for making the decisions (speed and steering). The car makes the autonomous driving decisions relying on 8 high-definition cameras with 36 frames per second, pumping millions of data elements every second to the FSD chip. Other companies use high-definition maps and radar technology, which Tesla believes are inadequate because of their speed, weight, cost, inaccuracy and inability to handle new situations; Tesla believes that vision is the only way to go, and I tend to agree with them: vision is the closest implementation to how the human brain operates, and with the proper training, computers can be even better and faster than humans.

Andrej Karpathy, Tesla AI chief has talked extensively in many venues about the Tesla AI strategy and technology, and how it is different from other approaches. In June 2021, he gave a talk about the Tesla autonomous driving at the CVPR 2021 Workshop on Autonomous Vehicles that explains the strategy and technology in a very concise yet comprehensive manner.

Source: YouTube Remo Uherek Channel: Andrej Karpathy Tesla Autonomous Driving Talk CVPR 2021

Tesla potentially is the fastest company in the world adopting new technology. Károly Zsolnai-Fehér demonstrates on his YouTube channel, Two Minute Papers video, “Watch Tesla’s Self-Driving Car Learn In a Simulation!” how Tesla has been adopting the latest research in AI and Deep Learning in its autonomous driving technology.

The amount of real driving data that Tesla has is at least an order of magnitude larger than all the other competitors combined. The reason is using its fleet (sold cars) to collect data and none of the competitors is doing that yet. Whether the car has been on the auto pilot or not, it is collecting data about the driving and sending it to Tesla using WiFi overnight. If the driver has not deployed the auto pilot, he/she would be driving in “shadow mode” where his driving habits are compared against the decisions that the auto pilot would have made; any discrepancies are sent to Tesla for analysis and training the neural networks.

Battery Strategy

Almost all auto manufacturers are using third parties to build their EV batteries, for example Panasonic, LG Chem or CATL. While Tesla still buys batteries from these producers, it is anticipating that there will be a shortage of supply of batteries as the usage of EVs proliferates. As a result, Tesla is manufacturing its own batteries as well. Simply said, Tesla wants to get their hand on any and every battery cell possible to be able to make more cars, thereby supporting the demand for Tesla cars.

According to Elon Musk in Battery Day 2020, “with the current battery design, we will need an equivalent of 135 Giga Factories similar to the one in Nevada to support the demand for electric vehicles.” This will simply not happen because of the mere logistics and cost. So, to address this problem, the design of the batteries needs to be more efficient, cheaper, more energy dense and with higher output.

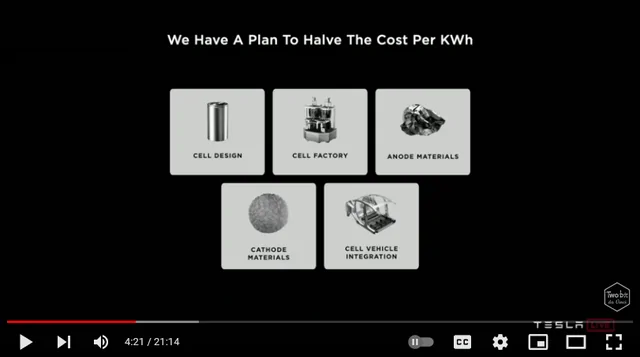

Ricky from Two bit da Vinci provides an excellent overview of the five key areas that Tesla is addressing in its battery strategy through his video review of Tesla Battery Day of September 2020. The five key areas which will cut the cost of Tesla batteries by 56% are:

Source You Tube Channel, Two Bit da Vinci: Tesla's Future Battery Strategy Explained

Studying the technical details of Tesla’s battery strategy and comparing it to its competition I came to the conclusion that Tesla’s battery strategy is leaving its competition, maybe with the exception of GM, in the dust. This was substantiated by Phil LeBeau’s article for CNBC: “Tesla’s lead in batteries will last through decade while GM closes in”. In this article, Phil demonstrates that Tesla’s battery cost (the single most expensive component of an EV) is $142 per KWH, whereas the industry average is $186 per KWH, and that this cost advantage is expected to last at least for a decade.

Solar Strategy

Tesla is the only auto manufacturer that is in involved in solar energy. Some may justifiably wonder about the logic and the relationship between solar panels and auto manufacturing, and I was one of them. I later came to the conclusion that there are two key links between EV manufacturing and solar panels:

(1) Energy Storage for Car Charging: The power grid operates based on Alternating Current, and the EV battery requires Direct Current. Charging the EV battery from the grid uses a “rectifier”, and part of the power is lost from the conversion. At the same time, solar panels generate DC and to add it to the grid, we use an “inverter”; some power is also lost through this conversion.

So, let’s visualize this scenario. A house roof is covered with solar panels, the power generated from these solar panels are stored in a battery (e.g. Tesla’s Powerwall), and the parked car is charged from the Powerwall. In such a situation, we will have no conversion and no lost power.

With the growth of electric vehicles, the electric grid will suffer significantly, and unless something is done we will experience intermittent blackouts. The above scenario is the solution, and I personally believe that 20 years from now, it will be rare for houses at sunny locations not to have this architecture.

Source: Tesla Powerwall

(2) Charging EVs with solar panels while driving or parking: The current technology of solar panels does not provide enough power to charge cars while driving. Having said that, I believe that the solar panel technology will continue improving to allow for providing partial power while driving, and charging the car battery while parking. I expect to see this in cars with larger surfaces like trucks before seeing it passenger cars.

Tesla already announced that they are planning to provide solar panels for the Cybertruck to add 15 miles of range per day. This did not assume that there are retractable solar panels. The retractable solar panels shown in the next video are created by the 3D artist Slav Popovski on Twitter.

Source: You Tube, Your Dad Academy Channel: Tesla Cybertruck Solar Panels

Tesla is unique among its competitors as it is the only company that has the expertise in three key areas:

Tesla is a cash-rich company with over $16B in cash and cash equivalents with (almost) no debts. In February 2021, Tesla bought $1.5B worth of Bitcoin (BTC-USD), which has more than doubled since then. Although this appreciation does not show on the balance sheet, it is practically cash in the bank.

I personally believe that Bitcoin is now considered the “new storage of value” or “the new gold”, and its value will continue increasing steadily as more investors park their investment in it.

Source: Composite created by author

The size and timing of this strategy is very unique for Tesla and will result in positively contributing to the bottom line and thereby the company valuation.

Tesla’s Patent Portfolio

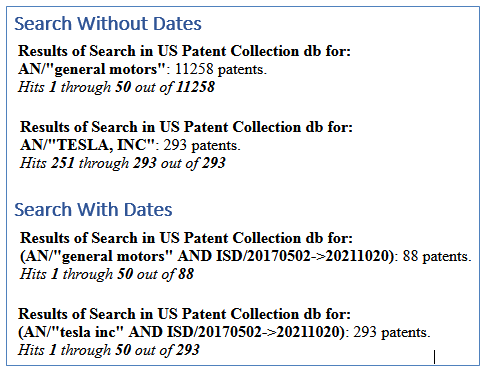

Tesla has a total of 293 issued patents, plus many other patents pending (433 as of 2021/10/20). This number pales compared to the 11,258 patents that General Motors (NYSE:GM) holds. However, when we take into consideration that Tesla’s patents were issued only from 2017/05/02 through 2021/10/19, GM’s patents during this period were only 88.

Tesla had a total of over 700 patents worked on over the last four years, and this amounts to approximately a new patent application every two days. This demonstrates a very high level of commitment to innovation and creativity in the company. In addition to this level of commitment, this is a volume of patents that is not matched by any auto manufacturer.

Source: US Patent & Trademark Office, Author Searches

Chinese Presence

Tesla’s Shanghai’s Giga Factory was built from a dirt ground to be fully functional within only 15 months; this is a remarkable achievement under any criteria. In addition, China is the biggest auto market and Tesla was the first foreign company that has a 100% owned factory in China. The company expects the Shanghai factory to continue to scale to produce over 1,000,000 cars a year and there are rumours of a second Giga Factory in China.

Source: Tesla Battery Day Slides, September 2020

This adds significantly to Tesla’s advantages compared to its competitors. Even compared to its Chinese competitors trading on US exchanges: NIO (NYSE:NIO), XPeng (NYSE:XPEV) and Li Auto (NASDAQ:LI), Tesla ships five times as much cars in China than these three companies combined (SupChina, All the electric car companies in China).

Manufacturing Automation

Tesla currently has six factories in California (the first Fremont factory), Nevada, Texas, New York, Shanghai and the latest one in Berlin. In addition, there are rumours about new Giga factories in China, India, Japan, Korea and the UK. Electrek provides an excellent review of the different Tesla factories and I suggest reading it for more details.

Source: electrek, Tesla factory locations: Where they are and could soon be

Looking at the design and the operations of a Giga factory is mesmerizing. The level of automation in these factories is akin to something from science fiction.

According to Elon Musk in October 2020, Tesla’s production lines are already over 75% automated, and growing; this is clearly demonstrated in Shanghai new Giga Factory video.

That high level of automation provides two key benefits: First, it achieves a high level of economies of scale, where the per-unit cost drops as the volume increases. Second, the automation provides a very high level of quality and precision that cannot be matched by the human eye.

In other words, Tesla has a distinct advantage with its level of automation where it would be able to drop the per-unit cost/price, while increasing its per-unit income. This is bound to happen as the production volume for Tesla increases.

The New Business Model Introduced by Tesla

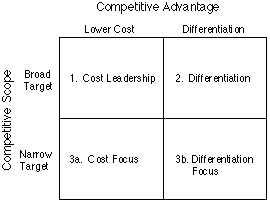

According to Michael Porter in his 1985 book, Competitive Advantage, there are only two strategies that provide a company with a competitive advantage; trying to adopt both strategies would result in lost profitability on the long term. The two generic competitive advantages are (1) Cost Leadership, (2) Differentiation. The competitive scope can either be the broad target or the focused target. The next diagram summarizes the competitive strategy landscape that Porter believes the companies can adopt; this diagram is the essence of the 500-page book, which I strongly suggest that you read.

Source: Michael Porter, Competitive Advantage, 1985

Through its vertical integration and its manufacturing automation efficiencies, the cost of Tesla cars will be reduced significantly. It would be extremely hard, if not impossible, for a competitor to provide the same quality of cars at the same price as Tesla and this would render Tesla to be the cost leader.

In addition, the company is highly innovative, and will continue being the market leader for EV technology. The company has developed an innovation culture that trickles down from the top. The company never shied away from reaching out to what some have indicated is “impossible” and has been the first in so many areas that listing them would require a separate article.

I believe that Tesla is the only company that is capable in competing in the full spectrum without being “stuck in the middle”. The above analysis indicates that Michael Porter’s model that stood its ground for over 40 years is now on the verge of being re-written by Tesla.

The Justification of Tesla’s $3 Trillion Valuation

At the beginning of the article, I identified the following assumptions to achieve the current valuation of about $900B for Tesla:

Source: Created by Author

Source: Created by Author

This is all good and rosy; what can go wrong?

Like in any investment opportunity, there are always risks and uncertainties. Following are some of the risks that should be taken into consideration when making a Tesla investment decision:

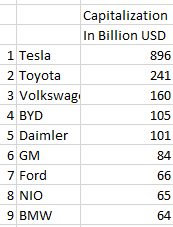

Tesla has defied all odds to be a world leader in many different areas. The market has rewarded Tesla handsomely, and gave it a capitalization higher than the total of its next 8 competitors combine as shown in the next chart.

Source: Compiled by Author as of 2021/10/21

According To Iman Ghosh in her article The World’s Top Car Manufacturers by Market Capitalization in January 2021: “Tesla’s competitive advantage comes as a result of its dedicated emphasis on research and development (R&D). In fact, many of its rivals have admitted that Tesla’s electronics far surpass their own - a teardown revealed that its batteries and AI chips are roughly six years ahead of other industry giants such as Toyota and Volkswagen.” Based on the analysis presented earlier, I see this 6-year gap increasing, and with Tesla dropping its price, it would command 50% of all new car sales within 15 years. Some may consider this a bold prediction, and only time will tell.

When this happens, I expect that investors would consider the $3T capitalization of Tesla to be a very low one.

This article was written by

Ramy Taraboulsi, CFAFollow

2.11K Followers

Managing Director and CEO, VeritableSoft Innovations Inc. Ramy is responsible for all the day-to-day opera...

https://seekingalpha.com/article/4461896-tesla-stock-justification-for-3-trillion-company

Oct. 25, 2021 8:00 PM ET Tesla, Inc. (TSLA)LI, NIO, XPEV28

Summary

- Tesla is currently valued at about $900B, and I consider this a low valuation for the company.

- Analyzing the company's operations and its competitive advantages demonstrates a very big lead over its competition, and this gap is almost impossible to close.

- Adjusting the valuation parameters based on the operational analysis render a capitalization of $3T for Tesla.

Xiaolu Chu/Getty Images News

What prompted this article?

Since I wrote my article about Tesla’s (NASDAQ:TSLA) April 2019 (Tesla: Why Did The Autonomy Vehicle Day Turn Me Bullish?), I have been following the company very diligently, studying every piece of news about it, and putting my money where my mouth is: On a weekly basis, I have been writing two put contracts priced at about 10-20% lower than the current price and expiring four weeks later; occasionally, I had to roll over these options for another four weeks at a lower strike price. This investment strategy has been generating for me a good consistent weekly income.

My bullish position on Tesla has been growing consistently the more I studied the company and its operations. I remember reading very negative articles related to Tesla’s competitive landscape and the financial position of the company. The commonality that I recognized in these articles is that the authors missed understanding the “new business model” that Tesla is introducing. I thus decided to write an article that expresses my opinion about how I see Tesla different from an operational and strategic perspective and how this difference renders its current valuation of $900B as “low”.

Summary and Paper Thesis

This article looks at the current Discounted Cash Flow model for Tesla and the growth rates that are taken into consideration to render its current price. The article then looks at the key competitive advantages that Tesla has and the new business model that it introduces; this is the bulk of the article.

Based on these advantages and the new business model the article adjusts the assumptions of the current valuation to come up with a new company valuation. The article then looks at the risks that Tesla could be facing.

Tesla’s Current Valuation

The theoretical way of conducting discounted cash flow analysis would adopt the following steps:

- Determine the adjusted company “free cash flow”; This is the key outcome of conducting the fundamental analysis of the company.

- Determine the period for high growth rate.

- Determine the growth rate within this period.

- Determine the perpetual growth rate for the company.

- Determine the hurdle rate to be used in the discounted cash flow for the company.

- Perform the Discounted Cash Flow, DCF, calculation to get the valuation for the company.

Here are the assumptions used to get the current valuation:

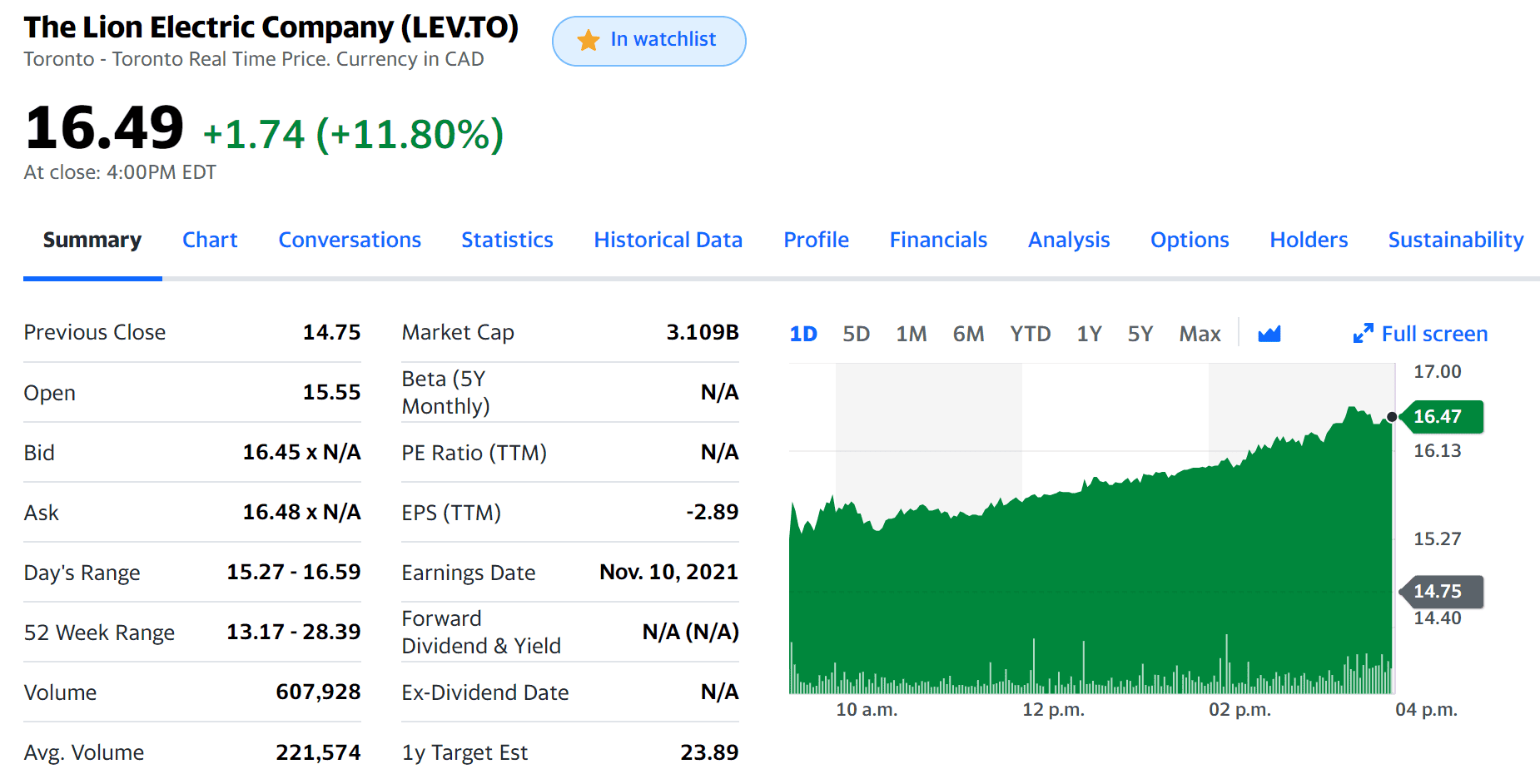

- According to Tesla’s Q3 Financial Results for the period ended September 30, 2021, Tesla’s free cash flow was $1.328B per quarter or $5.312B annually. While I believe that the free cash flow for the company is higher than the reported amount, I will not adjust it at this stage.

- I will assume that the abnormally high growth period lasts for 7 years. I believe that 7 is more appropriate than the norm of 5 years because of the reasons described below including the fact that the EV market will continue growing abnormally for at least that long.

- The abnormal growth rate is the plug variable in our DCF equation. Please note that Tesla’s net income for the quarter ending September 30, 2020 was $331M, and with $1,618M for the quarter ending September 30, 2021, this renders the growth rate to be 488% year over year; this would serve as a good reality check.

- We will assume a perpetual growth rate for the company at 8%.

- We will assume the hurdle rate to be 13.6%, which is Compounded Annual Growth Rate for the S&P over the last 10 years according to Goldman Sachs.

Source: Created by Author

Please note that the 54% growth rate calculated here is a conservative number given that the growth rate last year was 488%.

How is Tesla different from other auto manufacturers?

This section demonstrates the differences between Tesla and the competition which is trying to catch up. We will review here different areas that are sometimes over-looked by financial analysts.

Vertical Integration Strategy

In 2016, Elon Musk said that Tesla would be increasing vertical integration in order to “have the ability to produce almost any part of the car at will and alleviate risk with suppliers ... if 2% of suppliers aren’t ready, we can’t make the car.”

According to Behzad Benam in his Medium article: “Why Vertical Integration Made Tesla More Powerful”, the advantages of vertical integration for Tesla include:

- Efficient investment

- More control over product quality

- More control over the planning of production

- Less shipping cost and faster delivery

- Less dependence on suppliers

- More competitive advantages

- Avoid interference in the supply of required parts.

- Better product alignment with the needs of its in-house end product, where other suppliers meet many manufacturers' needs.

This video from Casgains Academy presents a very nice summary of how Tesla is using vertical integration to its advantage.

Source: YouTube Casgains Academy Channel: Tesla's Secret Weapon: Vertical Integration

To demonstrate how this vertical integration strategy was beneficial to Tesla, let’s look at the shutdowns that happened in auto manufacturing over the last 12 months because of supply chain crisis. The shutdown for Tesla was just for a few days in February 2021, which pales compared to the extended shutdowns of other manufacturers.

Source: Some Wall Street Journal articles about the Supply Chain Crisis

Chip Technology

One of the biggest challenges in Artificial Intelligence, AI, is the speed of the processors required for both training the neural networks and to make decisions based on the trained neural networks. Neural networks for autonomous driving need to be continuously retrained with new data, and the retraining is usually done with an ever larger amount of data elements. Corners cannot be cut in this training as mistakes are unforgiven when lives of passengers are on the line. In addition, computers that drive the autonomous driving decisions (speed and steering) need to be specifically designed for speed.

Except for Tesla, companies working on AI for autonomous driving are using GPUs from Nvidia (NASDAQ:NVDA) and (NASDAQ:AMD). These are generic processors that are designed for graphics processing with hundreds of CPUs within each chip. While the GPU speed is remarkable, they are still generic chips that are not as fast as chips specifically designed for autonomous driving.

Tesla has gone a different route and created its own chips for both the neural network training and for the processing the neural networks while driving; this is one of the reasons that Tesla might have been the only company that was not negatively impacted by the world chip shortages in 2021 which resulted in shutting down many auto manufacturers for extended periods.

In August 2021, at Tesla AI Day, Tesla Engineer Genesh Venugopal, discussed Project Dojo and the AI chip that will power the company's full self-driving technology neural network training. You can read about the impressive Dojo technology in Tesla’s published white paper: “Tesla Dojo Technology”.

Source, YouTube CNET Highlights Channel: Tesla's AI chip REVEALED! (Project Dojo)

In addition, Tesla designed the FSD chip; Tesla’s AI website describes the functions of this chip.

This two-pronged approach is a remarkable one that puts Tesla many years ahead of its competition.

Auto Pilot, Vision, Data and AI Technology

Tesla adopted a different philosophy in its autonomous driving, and that is to use vision for making the decisions (speed and steering). The car makes the autonomous driving decisions relying on 8 high-definition cameras with 36 frames per second, pumping millions of data elements every second to the FSD chip. Other companies use high-definition maps and radar technology, which Tesla believes are inadequate because of their speed, weight, cost, inaccuracy and inability to handle new situations; Tesla believes that vision is the only way to go, and I tend to agree with them: vision is the closest implementation to how the human brain operates, and with the proper training, computers can be even better and faster than humans.

Andrej Karpathy, Tesla AI chief has talked extensively in many venues about the Tesla AI strategy and technology, and how it is different from other approaches. In June 2021, he gave a talk about the Tesla autonomous driving at the CVPR 2021 Workshop on Autonomous Vehicles that explains the strategy and technology in a very concise yet comprehensive manner.

Source: YouTube Remo Uherek Channel: Andrej Karpathy Tesla Autonomous Driving Talk CVPR 2021

Tesla potentially is the fastest company in the world adopting new technology. Károly Zsolnai-Fehér demonstrates on his YouTube channel, Two Minute Papers video, “Watch Tesla’s Self-Driving Car Learn In a Simulation!” how Tesla has been adopting the latest research in AI and Deep Learning in its autonomous driving technology.

The amount of real driving data that Tesla has is at least an order of magnitude larger than all the other competitors combined. The reason is using its fleet (sold cars) to collect data and none of the competitors is doing that yet. Whether the car has been on the auto pilot or not, it is collecting data about the driving and sending it to Tesla using WiFi overnight. If the driver has not deployed the auto pilot, he/she would be driving in “shadow mode” where his driving habits are compared against the decisions that the auto pilot would have made; any discrepancies are sent to Tesla for analysis and training the neural networks.

Battery Strategy

Almost all auto manufacturers are using third parties to build their EV batteries, for example Panasonic, LG Chem or CATL. While Tesla still buys batteries from these producers, it is anticipating that there will be a shortage of supply of batteries as the usage of EVs proliferates. As a result, Tesla is manufacturing its own batteries as well. Simply said, Tesla wants to get their hand on any and every battery cell possible to be able to make more cars, thereby supporting the demand for Tesla cars.

According to Elon Musk in Battery Day 2020, “with the current battery design, we will need an equivalent of 135 Giga Factories similar to the one in Nevada to support the demand for electric vehicles.” This will simply not happen because of the mere logistics and cost. So, to address this problem, the design of the batteries needs to be more efficient, cheaper, more energy dense and with higher output.

Ricky from Two bit da Vinci provides an excellent overview of the five key areas that Tesla is addressing in its battery strategy through his video review of Tesla Battery Day of September 2020. The five key areas which will cut the cost of Tesla batteries by 56% are:

- Cell Design (14% of the cost per KWH reduction)

- Cell Factory (18% of the cost per KWH reduction)

- Anode Materials (5% of the cost per KWH reduction)

- Cathode Materials (12% of the cost per KWH reduction)

- Cell-Vehicle Integration (7% of the cost per KWH reduction)

Source You Tube Channel, Two Bit da Vinci: Tesla's Future Battery Strategy Explained

Studying the technical details of Tesla’s battery strategy and comparing it to its competition I came to the conclusion that Tesla’s battery strategy is leaving its competition, maybe with the exception of GM, in the dust. This was substantiated by Phil LeBeau’s article for CNBC: “Tesla’s lead in batteries will last through decade while GM closes in”. In this article, Phil demonstrates that Tesla’s battery cost (the single most expensive component of an EV) is $142 per KWH, whereas the industry average is $186 per KWH, and that this cost advantage is expected to last at least for a decade.

Solar Strategy

Tesla is the only auto manufacturer that is in involved in solar energy. Some may justifiably wonder about the logic and the relationship between solar panels and auto manufacturing, and I was one of them. I later came to the conclusion that there are two key links between EV manufacturing and solar panels:

(1) Energy Storage for Car Charging: The power grid operates based on Alternating Current, and the EV battery requires Direct Current. Charging the EV battery from the grid uses a “rectifier”, and part of the power is lost from the conversion. At the same time, solar panels generate DC and to add it to the grid, we use an “inverter”; some power is also lost through this conversion.

So, let’s visualize this scenario. A house roof is covered with solar panels, the power generated from these solar panels are stored in a battery (e.g. Tesla’s Powerwall), and the parked car is charged from the Powerwall. In such a situation, we will have no conversion and no lost power.

With the growth of electric vehicles, the electric grid will suffer significantly, and unless something is done we will experience intermittent blackouts. The above scenario is the solution, and I personally believe that 20 years from now, it will be rare for houses at sunny locations not to have this architecture.

Source: Tesla Powerwall

(2) Charging EVs with solar panels while driving or parking: The current technology of solar panels does not provide enough power to charge cars while driving. Having said that, I believe that the solar panel technology will continue improving to allow for providing partial power while driving, and charging the car battery while parking. I expect to see this in cars with larger surfaces like trucks before seeing it passenger cars.

Tesla already announced that they are planning to provide solar panels for the Cybertruck to add 15 miles of range per day. This did not assume that there are retractable solar panels. The retractable solar panels shown in the next video are created by the 3D artist Slav Popovski on Twitter.

Source: You Tube, Your Dad Academy Channel: Tesla Cybertruck Solar Panels

Tesla is unique among its competitors as it is the only company that has the expertise in three key areas:

- EV manufacturing

- Solar panel production

- Battery storage

Bitcoin StrategyPersonal Prediction: Once Tesla makes the announcement of a passenger car with solar panels that partially charges the battery while driving or while parked in the sun, the demand for such a car would be staggering and the wait period for these cars would exceed six months.

Tesla is a cash-rich company with over $16B in cash and cash equivalents with (almost) no debts. In February 2021, Tesla bought $1.5B worth of Bitcoin (BTC-USD), which has more than doubled since then. Although this appreciation does not show on the balance sheet, it is practically cash in the bank.

I personally believe that Bitcoin is now considered the “new storage of value” or “the new gold”, and its value will continue increasing steadily as more investors park their investment in it.

Personal Prediction: Gold investors will eventually abandon gold as the preferred storage of value and shift their investments to Bitcoin; this will result in significantly increasing the value of bitcoin.

Source: Composite created by author

The size and timing of this strategy is very unique for Tesla and will result in positively contributing to the bottom line and thereby the company valuation.

Tesla’s Patent Portfolio

Tesla has a total of 293 issued patents, plus many other patents pending (433 as of 2021/10/20). This number pales compared to the 11,258 patents that General Motors (NYSE:GM) holds. However, when we take into consideration that Tesla’s patents were issued only from 2017/05/02 through 2021/10/19, GM’s patents during this period were only 88.

Tesla had a total of over 700 patents worked on over the last four years, and this amounts to approximately a new patent application every two days. This demonstrates a very high level of commitment to innovation and creativity in the company. In addition to this level of commitment, this is a volume of patents that is not matched by any auto manufacturer.

Source: US Patent & Trademark Office, Author Searches

Chinese Presence

Tesla’s Shanghai’s Giga Factory was built from a dirt ground to be fully functional within only 15 months; this is a remarkable achievement under any criteria. In addition, China is the biggest auto market and Tesla was the first foreign company that has a 100% owned factory in China. The company expects the Shanghai factory to continue to scale to produce over 1,000,000 cars a year and there are rumours of a second Giga Factory in China.

Source: Tesla Battery Day Slides, September 2020

This adds significantly to Tesla’s advantages compared to its competitors. Even compared to its Chinese competitors trading on US exchanges: NIO (NYSE:NIO), XPeng (NYSE:XPEV) and Li Auto (NASDAQ:LI), Tesla ships five times as much cars in China than these three companies combined (SupChina, All the electric car companies in China).

Manufacturing Automation

Tesla currently has six factories in California (the first Fremont factory), Nevada, Texas, New York, Shanghai and the latest one in Berlin. In addition, there are rumours about new Giga factories in China, India, Japan, Korea and the UK. Electrek provides an excellent review of the different Tesla factories and I suggest reading it for more details.

Source: electrek, Tesla factory locations: Where they are and could soon be

Looking at the design and the operations of a Giga factory is mesmerizing. The level of automation in these factories is akin to something from science fiction.

According to Elon Musk in October 2020, Tesla’s production lines are already over 75% automated, and growing; this is clearly demonstrated in Shanghai new Giga Factory video.

That high level of automation provides two key benefits: First, it achieves a high level of economies of scale, where the per-unit cost drops as the volume increases. Second, the automation provides a very high level of quality and precision that cannot be matched by the human eye.

In other words, Tesla has a distinct advantage with its level of automation where it would be able to drop the per-unit cost/price, while increasing its per-unit income. This is bound to happen as the production volume for Tesla increases.

The New Business Model Introduced by Tesla

According to Michael Porter in his 1985 book, Competitive Advantage, there are only two strategies that provide a company with a competitive advantage; trying to adopt both strategies would result in lost profitability on the long term. The two generic competitive advantages are (1) Cost Leadership, (2) Differentiation. The competitive scope can either be the broad target or the focused target. The next diagram summarizes the competitive strategy landscape that Porter believes the companies can adopt; this diagram is the essence of the 500-page book, which I strongly suggest that you read.

Source: Michael Porter, Competitive Advantage, 1985

Through its vertical integration and its manufacturing automation efficiencies, the cost of Tesla cars will be reduced significantly. It would be extremely hard, if not impossible, for a competitor to provide the same quality of cars at the same price as Tesla and this would render Tesla to be the cost leader.

In addition, the company is highly innovative, and will continue being the market leader for EV technology. The company has developed an innovation culture that trickles down from the top. The company never shied away from reaching out to what some have indicated is “impossible” and has been the first in so many areas that listing them would require a separate article.

I believe that Tesla is the only company that is capable in competing in the full spectrum without being “stuck in the middle”. The above analysis indicates that Michael Porter’s model that stood its ground for over 40 years is now on the verge of being re-written by Tesla.

The Justification of Tesla’s $3 Trillion Valuation

At the beginning of the article, I identified the following assumptions to achieve the current valuation of about $900B for Tesla:

- Starting annual free cash flow: $5.312B

- High-period growth: 7 years

- High-period growth rate: 54%

- Perpetual growth rate: 8%

- Hurdle rate: 13.6%

- Much of the free cash flow that Tesla is reporting is based on it considering most of its investments as non-discretionary. As a rule of thumb, I usually take the average between the net income and the operational cash flow as the free cash flow for the company; I cannot justify this formula but based on 30+ years of financial analysis it has proven to be true to me. Tesla’s last quarterly net income was $1.618B, and its cash flow from operations was $3.147B, rendering the mid point between these two figures to be $2.383B, rendering the starting annual free cash flow for the company to be $9.53B

- I would drop the perpetual high-growth rate for the company to be 6 years from 7 years as shown in point-3 below.

- The current valuation assumes that Tesla’s growth rate within the seven years is 54%. Assuming that the growth rate drops by 50% year over year for the five years, starting from the current 488, we would get an average growth rate of 80%.

Source: Created by Author

- I will keep the perpetual growth rate at 8% as per point 3 above.

- I will keep the hurdle rate at 13.6%.

This is all good and rosy; what can go wrong?

Like in any investment opportunity, there are always risks and uncertainties. Following are some of the risks that should be taken into consideration when making a Tesla investment decision:

- Prevalence of hybrid cars: Not everyone agrees with EVs will be the future; for example, Toyota CEO, Akio Toyoda has been vocal about his hate for full electric cars and his belief that hybrids are the way to go. The comparison between fully electric and hybrid cars may be the subject of another article. James Morris of Forbes dissected Akio’s position in his October 2021 article, Why Toyota Has Got It Wrong On Electric Cars. I personally believe that hybrid cars proving to be more popular than fully electric cars is potentially the biggest risk that Tesla is currently facing.

- New energy/battery technology: While not anticipated any time soon, there is a possibility that a new battery technology would come up and render Tesla’s investments obsolete. If something like this happens, it would result in a very high cost for Tesla to switch its operations to the new more efficient technology. Hydrogen fuel cells may be this technology and time will tell.

- Vision for FSD proves to be inadequate: Tesla bet all its AI and technology resources on vision being the driver for FSD. I do agree with this vision, pun intended, but there is a risk that a better technology will come up which would put a serious dent in Tesla’s position.

- Inflation: Tesla mostly sells their cars by entering into contracts for cars that would be future delivered based on the current prices. If we face a strong inflationary environment, the margins for Tesla would be seriously curtailed, and these contracts may even result in a loss rather than a gain for the company.

- Regulatory changes: This is the joker card on the deck, and it can go either way. The current prices are assuming that the regulatory environment would be friendly to electric vehicles because of environmental reasons. If serious environmental issues emerge (for example, recycling of batteries), the regulation may turn to be unfriendly, and this would serve a serious blow to Tesla’s prospects.

- Is Tesla's Stock Forecast Impacted By Rivian R1T Electric Truck?

- The Occam's Razor That Tesla Bulls Ignore And Which Breaks The Long-Term Expectations

- Tesla May Have A Safety Problem

- Tesla's Q3: The Good, The Bad, And The Ugly

- Tesla Pays Out Years Of Profits Highlighting Its Unprofitable Business

- Tesla: Incredible Progress Is Being Made But It's Still An Overvalued Car Company

Tesla has defied all odds to be a world leader in many different areas. The market has rewarded Tesla handsomely, and gave it a capitalization higher than the total of its next 8 competitors combine as shown in the next chart.

Source: Compiled by Author as of 2021/10/21

According To Iman Ghosh in her article The World’s Top Car Manufacturers by Market Capitalization in January 2021: “Tesla’s competitive advantage comes as a result of its dedicated emphasis on research and development (R&D). In fact, many of its rivals have admitted that Tesla’s electronics far surpass their own - a teardown revealed that its batteries and AI chips are roughly six years ahead of other industry giants such as Toyota and Volkswagen.” Based on the analysis presented earlier, I see this 6-year gap increasing, and with Tesla dropping its price, it would command 50% of all new car sales within 15 years. Some may consider this a bold prediction, and only time will tell.

When this happens, I expect that investors would consider the $3T capitalization of Tesla to be a very low one.

This article was written by

Ramy Taraboulsi, CFAFollow

2.11K Followers

Managing Director and CEO, VeritableSoft Innovations Inc. Ramy is responsible for all the day-to-day opera...

https://seekingalpha.com/article/4461896-tesla-stock-justification-for-3-trillion-company